- Top News

Calculating Your Budget: What Can You Afford with Owner Financing?

- By richshelor@icloud.com

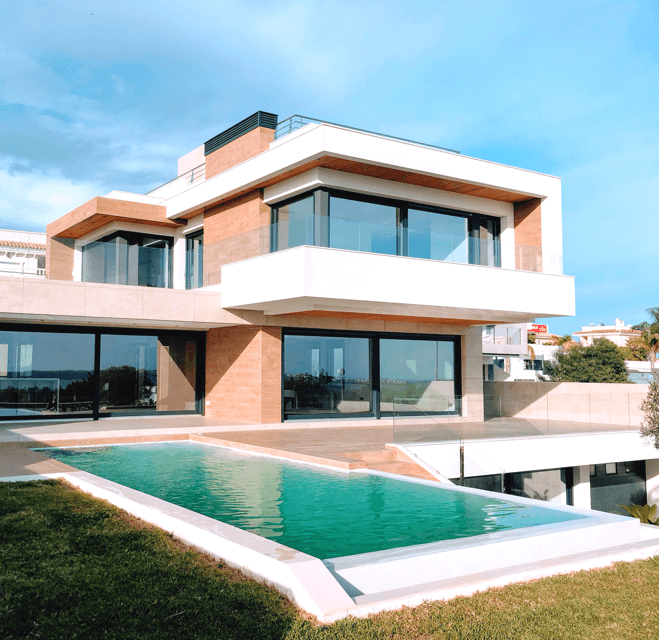

Owner financing offers a unique opportunity for homebuyers, especially those who may struggle to secure a traditional mortgage. However, with flexibility comes responsibility. It’s vital to understand what you can realistically afford before jumping into an owner financing deal. Calculating your budget isn’t just about the monthly payment; it’s about factoring in all costs to ensure long-term financial stability. This article will guide you through the budgeting process step by step, so you can confidently approach owner financing and find a home that fits your financial reality.

1. Start with the Purchase Price

The first step in calculating your budget is to determine the maximum purchase price you can afford. This figure will guide your home search and help you focus on properties within your financial reach.

How to determine your purchase price:

Income-Based Calculation: A general rule of thumb is to aim for a home price that is three to five times your annual household income. For example, if your household income is $80,000, your target home price might range from $240,000 to $400,000.

Debt-to-Income Ratio (DTI): Your DTI ratio, which compares your monthly debt payments to your gross monthly income, should not exceed 43%. This includes your projected mortgage payment, credit card bills, car loans, and other debt obligations.

Existing Debt: If you have significant existing debt, you may need to adjust your target purchase price downward to maintain a comfortable DTI ratio.

Understanding the purchase price that aligns with your income and debt will prevent you from overextending yourself financially.

2. Factor in the Down Payment

With owner financing, the down payment typically ranges from 5% to 10% of the purchase price. The size of your down payment directly impacts your monthly payments and the total interest paid over the loan term.

Key considerations:

Down Payment Percentage: If you’re looking at a $300,000 home, a 10% down payment would be $30,000, while a 5% down payment would be $15,000. The more you can put down upfront, the lower your monthly payments will be.

Emergency Fund: Make sure your down payment doesn’t deplete your savings. It’s essential to keep an emergency fund for unexpected expenses.

Negotiation Power: A higher down payment can also make your offer more attractive to sellers, giving you leverage to negotiate better terms.

Knowing how much you can afford to put down will help you set realistic expectations and plan your finances accordingly.

3. Calculate Your Monthly Payment

Once you’ve determined the purchase price and down payment, it’s time to calculate your monthly payment. Unlike traditional mortgages, owner financing payments can vary widely depending on the terms agreed upon with the seller.

Components of your monthly payment:

Principal and Interest: This is the core of your monthly payment. The principal is the amount borrowed, while the interest is the cost of borrowing that money. The interest rate is often higher in owner financing deals than in traditional mortgages.

Taxes and Insurance: Property taxes and homeowners insurance are typically included in your monthly payment. In some owner financing agreements, the seller may pay these costs directly, but they will usually be factored into the interest rate or payments.

Maintenance Costs: Unlike renting, homeownership comes with maintenance responsibilities. Be sure to budget for regular upkeep, repairs, and any potential emergencies.

Example Calculation:

Let’s say you’re purchasing a $300,000 home with a 10% down payment ($30,000). You’ve negotiated an interest rate of 7% with a 5-year loan term. Here’s a basic breakdown:

- Loan Amount: $270,000

- Interest Rate: 7%

- Loan Term: 5 years

Using a loan payment calculator, your estimated monthly payment (excluding taxes, insurance, and maintenance) would be approximately $5,346. Keep in mind, this amount can vary depending on the specific terms of your agreement.

4. Consider Additional Costs

Homeownership isn’t just about making mortgage payments. There are several additional costs to account for, which can significantly impact your budget.

Important additional costs:

Closing Costs: These can include attorney fees, title insurance, and recording fees. While traditional lenders often cover some closing costs, in owner financing deals, the buyer typically bears most of the expense. Expect to pay 2% to 5% of the purchase price.

Property Taxes: Property taxes vary widely depending on the location and value of the home. Ensure you know what the annual property tax is and how it will affect your budget.

Homeowners Insurance: This insurance protects your investment against damage or loss. The cost varies based on factors like location, home value, and coverage level. Make sure it’s factored into your monthly budget.

Repairs and Maintenance: Home repairs can be unexpected and costly. From roof repairs to HVAC system replacements, these expenses can add up. A good rule of thumb is to budget 1% to 3% of the home’s value annually for maintenance.

Factoring in these additional costs will give you a more realistic picture of what homeownership will cost with owner financing.

5. Assess Your Financial Stability

Before committing to an owner financing deal, it’s essential to take a hard look at your overall financial stability. This step ensures that you’re not just meeting your obligations today but also safeguarding your financial future.

Questions to consider:

Job Security: Is your income stable? Do you anticipate any changes in employment or income that could impact your ability to make payments?

Emergency Savings: Do you have at least three to six months of living expenses saved? This cushion is vital in case of unexpected financial challenges.

Long-Term Financial Goals: How does this home purchase fit into your broader financial plans? Are you saving for retirement, college, or other major expenses?

Ensuring you have a solid financial foundation will help you manage the responsibilities of homeownership and protect your investment.

6. Plan for the Future: Balloon Payments and Refinancing

Many owner financing agreements include a balloon payment, which is a large lump sum due at the end of the loan term. It’s crucial to have a plan in place for this payment, as it can be a significant financial hurdle.

Consider your options:

Refinancing: Ideally, you’ll be able to refinance into a traditional mortgage before the balloon payment is due. However, this depends on your credit score, income, and market conditions at the time.

Selling the Property: If refinancing isn’t an option, selling the property may allow you to pay off the balloon payment and potentially make a profit.

Saving in Advance: If neither refinancing nor selling is feasible, start saving for the balloon payment as early as possible.

Having a clear plan for handling the balloon payment ensures you won’t be caught off guard when the time comes.

Conclusion

Calculating your budget for owner financing is a crucial step in ensuring a successful and sustainable home purchase. By understanding your financial situation, accounting for all costs, and planning for the future, you can confidently pursue owner financing and find a home that fits your needs and goals. Remember, the key to success is not just in securing the deal but in managing it wisely over time.

Related Posts

Why use Realty Plus Flat Fee MLS Listing?

Modern Marketing

Why NOI Is the Single Most Important Number in CRE

NOI sits at the center of valuation, financing, asset management, and investor decision-making. Lenders care about it. Investors price off it. Operators optimize it. Miss NOI—or misunderstand it—and you’re flying blind.

Why use Realty Plus Flat Fee MLS Listing?

Dive into the modern way of selling your home with flat fee listings and discover the joy of saving big on commissions while taking full control of the process.

It’s all about making the most of cutting-edge tech and enjoying the simplicity and empowerment that comes with being your own real estate boss.

Is AI Coming to Realty Plus Flat Fee MLS Listing?

Dive into the flat fee listing world and see how you can flip the script on selling your home. It’s the smart, modern way to get your property out there and get it sold, all while keeping more of that sale price where it belongs – with you.

The Top 5 Hidden Gems in Atlanta’s Real Estate Market: Underrated Neighborhoods to Consider

Discover the charm and potential of Atlanta’s hidden gems in the real estate market with our guide to five underrated neighborhoods. From the historic allure of Inman Park to the suburban tranquility of Underwood Hills, these areas offer a blend of affordability, character, and growth potential that savvy homebuyers and investors shouldn’t overlook. Explore these lesser-known locales for a unique and rewarding Atlanta living experience.

Maximizing ROI with “Simple Sell” Marketing in 2024: A Comprehensive Guide for Homeowners

Thinking about selling your home in 2024? With “Simple Sell” marketing, you can maximize your return on investment (ROI) while minimizing the hassle and cost of traditional real estate services. Discover how our streamlined approach helps homeowners sell quickly and profitably, even without extensive real estate experience.

Maximizing Your Home’s Value: Top Affordable Renovations to Boost Sale Price

Looking to sell your home for top dollar? Discover affordable and impactful renovations that can significantly increase your home’s market value. From simple updates to strategic upgrades, learn how to make your home irresistible to buyers without breaking the bank.

Staging Secrets: How to Make Your Home Irresistible to Buyers

Want to sell your home quickly and for top dollar? Discover the art of home staging with our expert tips and tricks. From decluttering to creating inviting spaces, learn how to make your home irresistible to buyers and stand out in the competitive real estate market.

Explore and travel the world

Guide to Owner Financing: How You Can Buy a Home with Just 5%-10% Down

Is Owner Financing Right for You? Key Questions to Ask

Calculating Your Budget: What Can You Afford with Owner Financing?

Navigating Owner Financing Terms: What You Need to Know Before Signing

Advance AI Business Analysis

Why NOI Is the Single Most Important Number in CRE

Why use Realty Plus Flat Fee MLS Listing?

Is AI Coming to Realty Plus Flat Fee MLS Listing?

The Top 5 Hidden Gems in Atlanta’s Real Estate Market: Underrated Neighborhoods to Consider

Maximizing ROI with “Simple Sell” Marketing in 2024: A Comprehensive Guide for Homeowners

© 2024 All Rights Reserved.